4. Duality and KKT conditions#

In this chapter we take a few steps back to consider some of the mathematical properties of the types of problems we are looking at. Understanding these is not strictly necessary - you could just use a modelling language to formulate and let the computer solve your problem while ignoring everything in this chapter.

However, understanding duality and KKT conditions will be useful in various ways. Duality can be exploited to perform sensitivity analyses and is important when using optimisation methods to solve market problems (Section 5). An understanding of KKT conditions will become relevant particularly when we look at mixed complementarity (Section 6) and non-linear programming problems. As you will see below, duality and KKT conditions are also related. Understanding one can help you understand the other, and vice versa.

4.1. Duality#

4.1.1. Introduction to duality#

In linear programming, for every problem, which we shall call the primal problem, there exists a “mirrored” problem that we call the dual problem. What’s important is that we (or a computer) can follow a set number of rules to transform the primal problem into the dual problem, and having the dual problem available opens up some interesting possibilities. We will get into these rules and the possibilities further below.

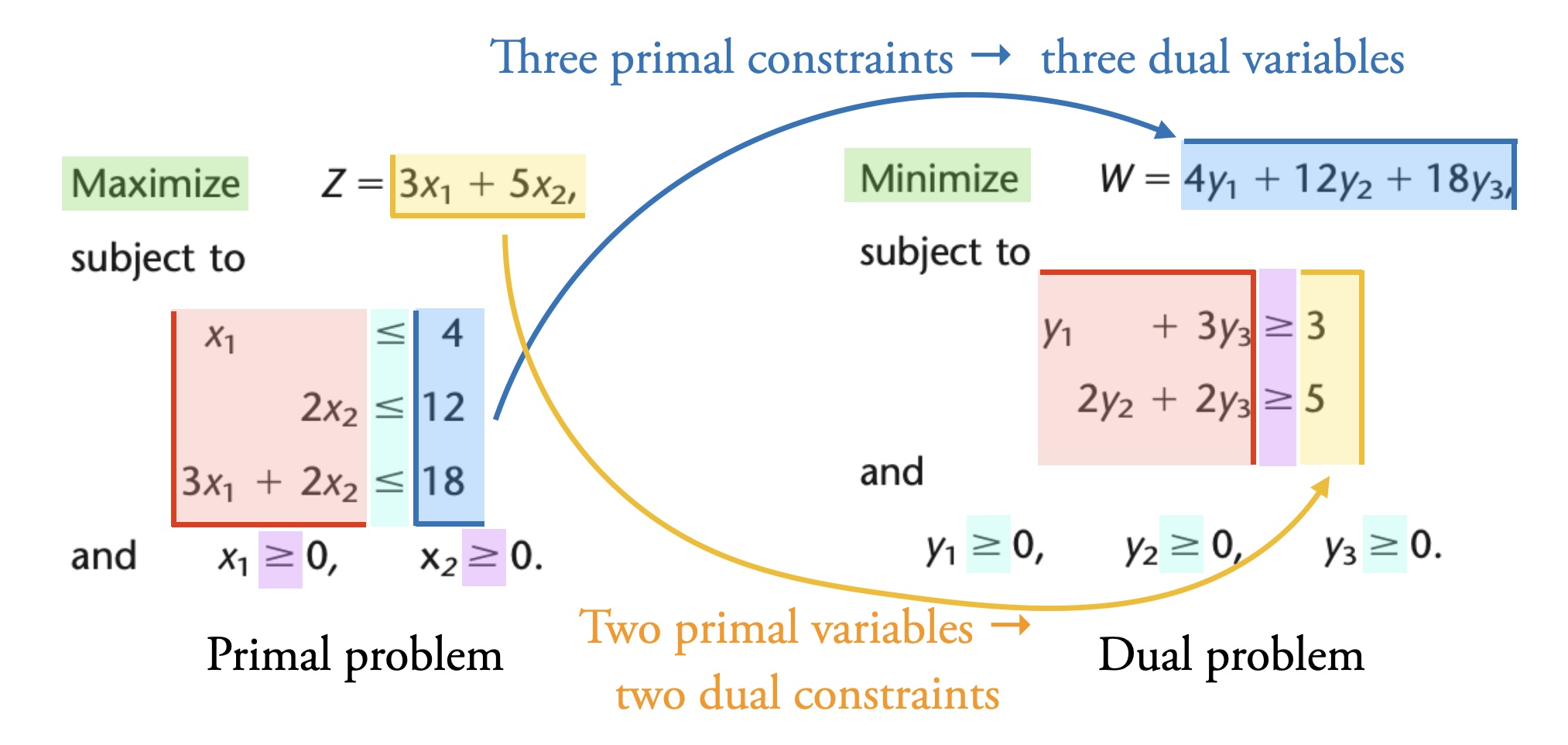

What a dual problem is, is best illustrated with an example. Consider this LP problem (from Table 6.1 in [Hillier and Lieberman, 2021]):

The corresponding dual problem is:

The color coding in Fig. 4.1 illustrates some important points:

Green: The dual problem of a maximisation primal problem is a minimisation problem (and vice versa).

Yellow: Two primal variables lead to two dual constraints. The primal objective function coefficients (3 and 5) are the dual constraint parameters.

Purple: The “

Blue: Three primal constraints lead to three dual variables. The primal constraint parameters (4, 12, and 18) are the dual objective function coefficients.

Cyan: The “

Red: The coefficients of the dual constraints are a “rotation” of the primal constraint coefficients.

Fig. 4.1 Relationship between primal and dual problem. Adapted from Table 6.1 in [Hillier and Lieberman, 2021].#

If we look at the solutions to the primal and dual problems, we see another important property of duality in linear problems: the optimal solution to the primal problem is the same value as the optimal solution to the dual problem. Furthermore, the shadow prices of the primal problem are the optimal variable values of the dual problem, and vice versa. The shadow prices of the primal problem in Fig. 4.1 are

Strong and weak duality

Weak duality means that the solution to any primal minimisation problem is always greater than or equal to the solution of the corresponding dual (maximisation) problem. Under certain conditions - and this includes the condition that we are dealing with linear optimisation - we also see strong duality, which means that the solution of the primal problem is equal to the solution of the dual problem. We only deal with the linear case here, where strong duality always applies. Thus we will not consider this distinction further, but it is something you will find discussed in detail elsewhere.

4.1.2. Economic dispatch example#

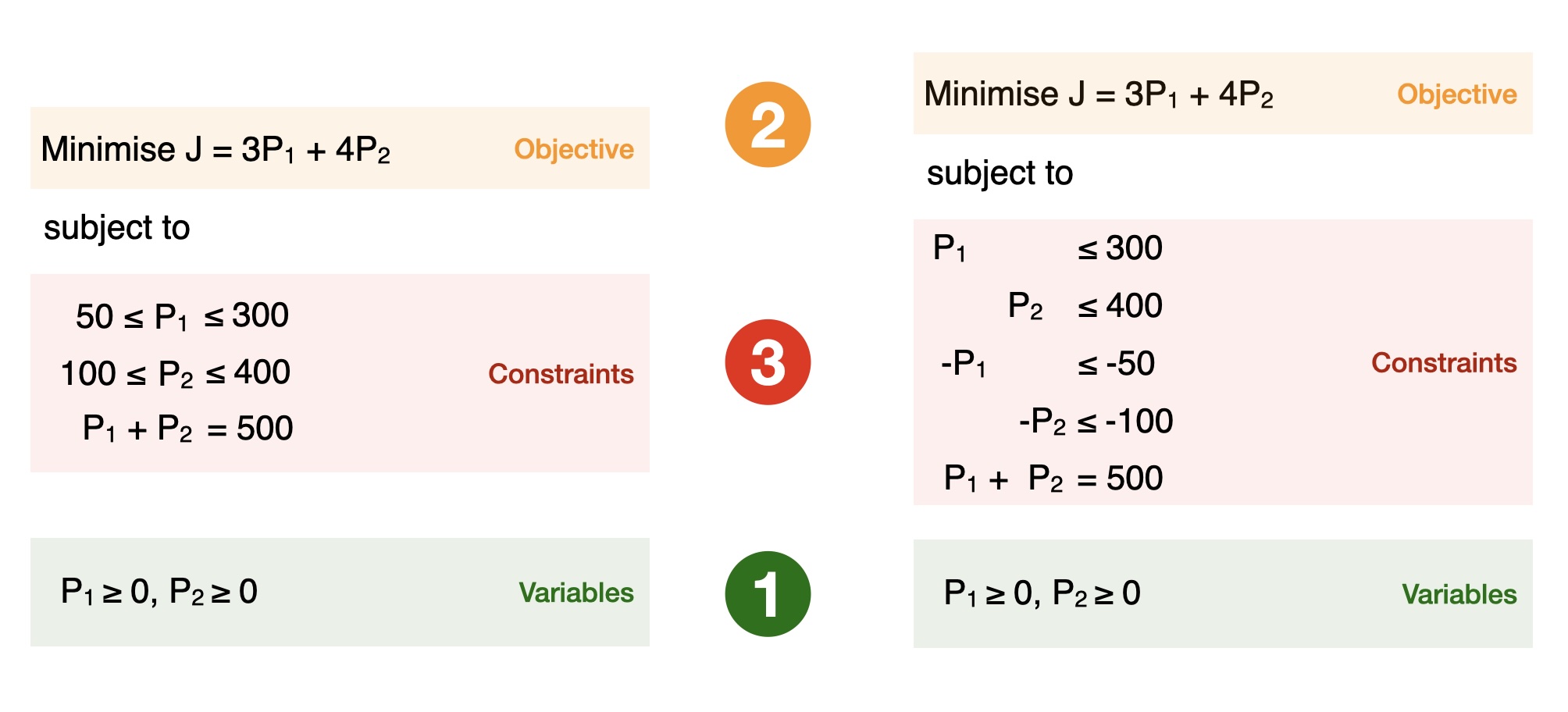

We will now revisit the economic dispatch problem from Section 2.1 and formulate the corresponding dual problem. Recall our economic dispatch problem:

We also have the variable bounds:

Now, to make our life easier, we will rewrite this problem into the standard form that we introduced in Section 2.8.1. We separate out the upper and lower limits on generation which are technically separate constraints, and give all the constraints the same sign.

Fig. 4.2 Modifying our economic dispatch example into a standard form.#

So our problem now looks like this:

It is up to us to pick the naming for the new variables in the dual problem. Often we write down the variable name we’ll use in the dual problem next to the corresponding constraint in the primal problem, which in the above example would look like this:

Now, we can use the rules in Table 4.1:

Primal |

Dual |

Minimise |

Maximise |

Variables |

Constraints |

Constraints |

Variables |

Unconstrained |

|

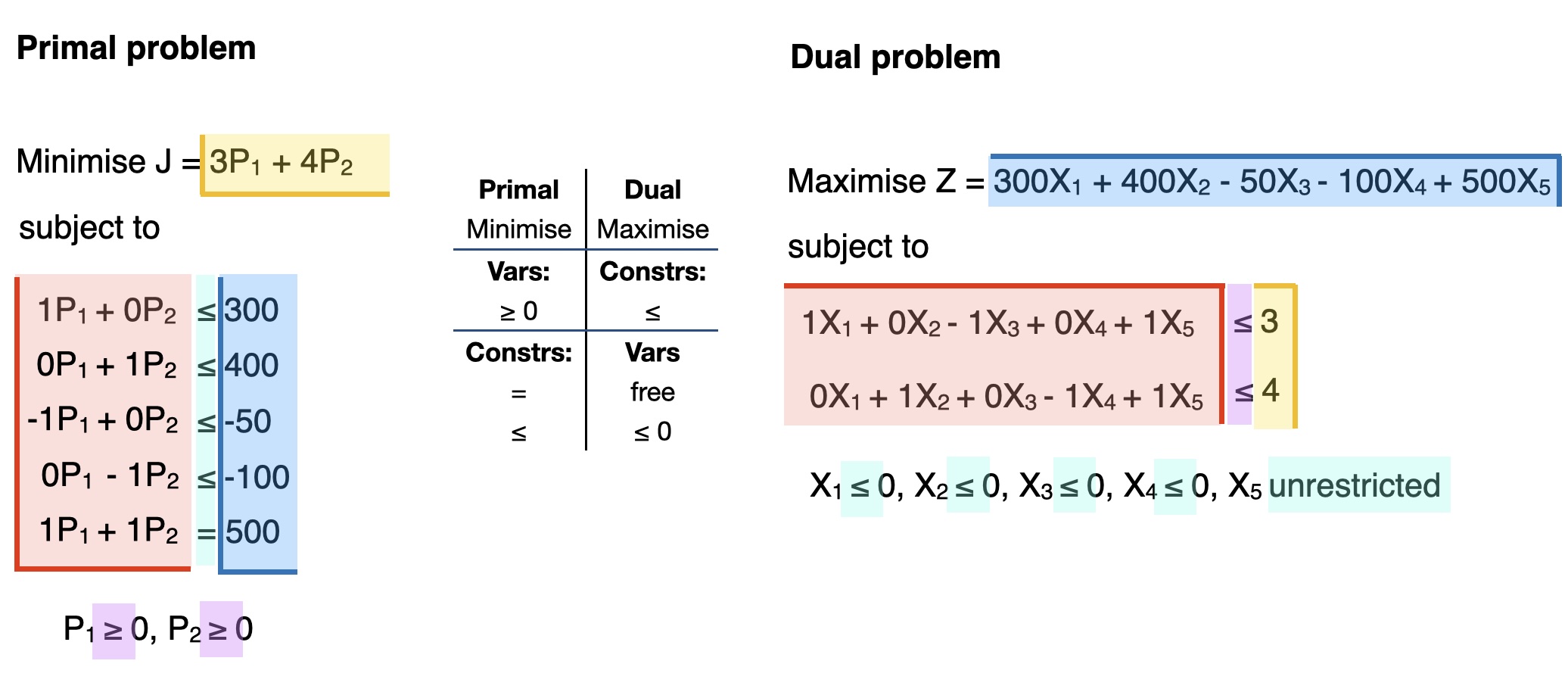

The dual problem becomes a maximisation problem. There are two primal variables of the form “

This is the resulting conversion:

Fig. 4.3 Converting our standard form economic dispatch example into its dual (maximisation) problem.#

We end up with this dual problem:

Our new variables are

Elaboration on constraints (red box in Fig. 4.3)

The left-hand side of the primal and dual constraints can be understood as a rotation of each other. In the context of the economic dispatch example:

Notice that when there is a factor of

We can solve the dual problem to obtain the optimal solution (

4.1.3. Strategies to convert a primal into its dual problem#

The easiest approach to convert a primal problem to its dual problem, and the one we use above, is:

Rewrite the primal problem to standard form

Follow the (standard, always same) steps to convert the standard-form problem to its dual

Summary of the recommended approach

Duality: conversion summary in the appendix contains a summary of this recommended approach with a generic example.

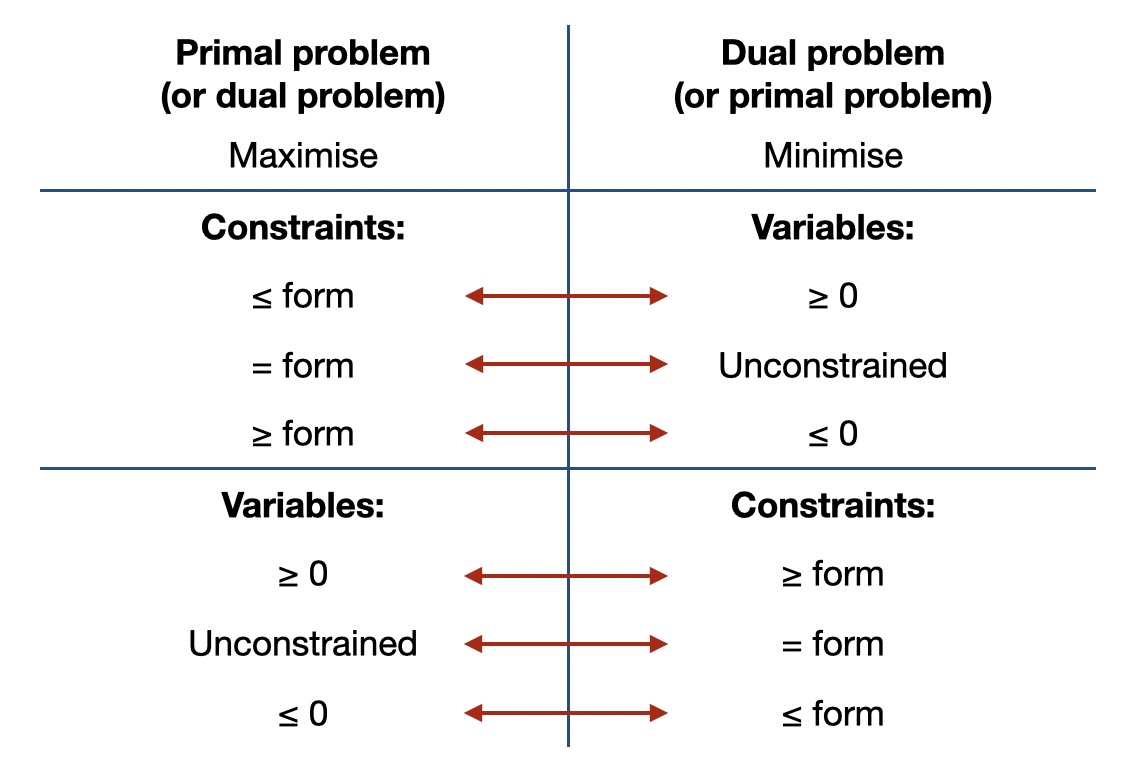

You do not have to rewrite to standard form first, however. There is a method called “SOB” which gives you a “map” on how to translate a primal problem into the corresponding dual problem, no matter what exact form it is in. In principle this also always works, but it can be a bit trickier to get your head around and it is easier to make mistakes.

The table in Fig. 4.4 shows you how what the rules in the SOB method are.

Fig. 4.4 How to convert a primal problem into a dual problem From the “SOB method”: Benjamin (1995), SIAM Review 37(1): 85-87 as summarised in [Hillier and Lieberman, 2021], Table 6.14**#

4.1.4. Additional examples#

In the appendix chapter “Duality: additional examples” you can find additional examples of duality, including an example of how duality allows you to see the same problem from two perspectives (the buyer and the seller of ingredients for a lunch).

4.2. Karush-Kuhn-Tucker (KKT) conditions#

In this section, we introduce the Karush-Kuhn-Tucker (KKT) conditions for convex optimisation problems with equality and inequality constraints. For such convex problems, these conditions form a set of conditions that describe all optimal solutions to the problem at hand. They form the basis for many numerical methods to solve optimisation problems and in simple cases allow determining the solution analytically. They also combine primal and dual variables, which offers additional insight in the solution (e.g., which constraints are active, or what is the electricity price in this system?).

We start from unconstrained optimisation and gradually introduce equality and inequality constraints. We will use an economic dispatch example to illustrate our approach.

4.2.1. Unconstrained optimisation#

Let’s go back to basic optimisation (high school mathematics). Whenever you had to optimise (minimise or maximise) a function, you were doing unconstrained optimisation. To determine the maximum or minimum of a certain function, we should take the derivative of that function with respect to (w.r.t.) the decision variable

A point that satisfies the necessary condition for optimality (

4.2.2. Equality constrained optimisation#

In energy systems, unfortunately we do not deal with many unconstrained optimisation problems—usually there are at least a few constraints. Consider the example of economic dispatch from Section 2.1. We will again use an economic dispatch example, and build up the complexity of the problem throughout this chapter to illustrate how we can use KKT conditions and duality to solve such problems and interpret their solutions.

Consider two generators

Unlike before, we now have a quadratic programming (QP) problem. This is still a convex optimisation problem. Therefore, the techniques we use here also apply to linear programming problems.

Reminder: convex optimisation

Convex optimisation means that we are dealing with convex functions over convex regions. Both linear and quadratic optimisation problems are convex. In general, however, many kinds of non-linear optimisation problems are non-convex, and we cannot apply the techniques we discuss here to them.

We need to dispatch the generators to meet a load

If we do not consider the equality constraint

To deal with the constraint in our optimisation problem, we introduce the Lagrangian. The Lagrangian elevates the constraint to the objective function.

The first part of the Lagrangian is the original objective function. Then we add the constraint multiplied by a Lagrange multiplier

To do this, we draw on our knowledge of unconstrained optimisation, since now we have a single function, the Lagrangian, to minimise. Thus, we take the first derivative of the Lagrangian w.r.t.

Notice that now we have three equations and three unknowns. So, we can solve for

Now we will generalise the Lagrangian to any equality constrained optimisation problem. Consider the following minimisation problem with equality constraints

The equality constraints are written in standard form (as introduced in Section 2.8.1), so we have “= 0” on the right-hand side. There are

The Lagrangian is then:

We can find the optimal solution (

Notation and standard form

You will notice that in this section, we write all constraints in a standard form with zeros on the right-hand side (i.e.,

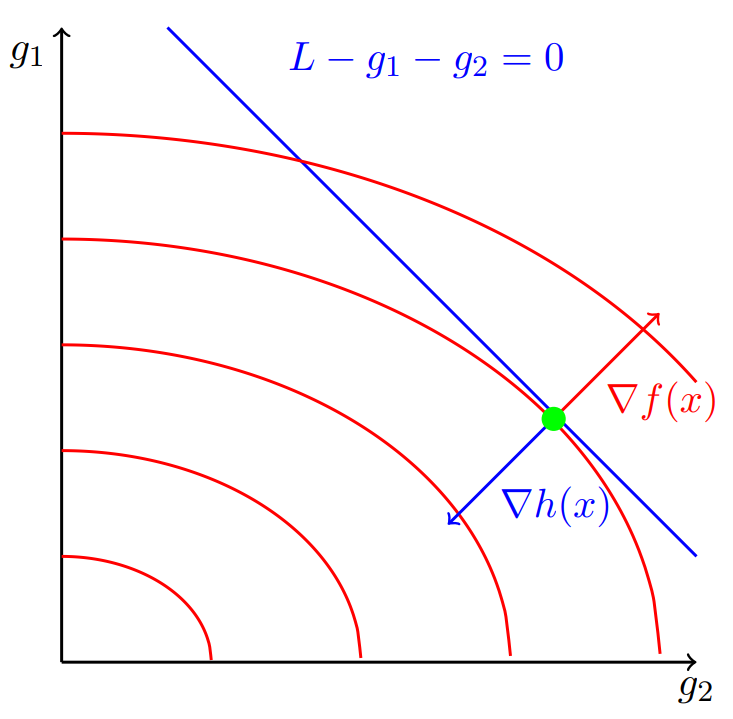

The equality constrained optmisation problem also has a graphical interpretation. Fig. 4.5 shows the graphical interpretation of our economic dispatch example.

Fig. 4.5 Graphical representation of the equality constrained economic dispatch problem#

4.2.3. Inequality and equality constrained optimisation#

In energy systems, we not only have equality constraints, but also inequality constraints. For example, returning to the economic dispatch example, the generators have maximum generation capacity constraints

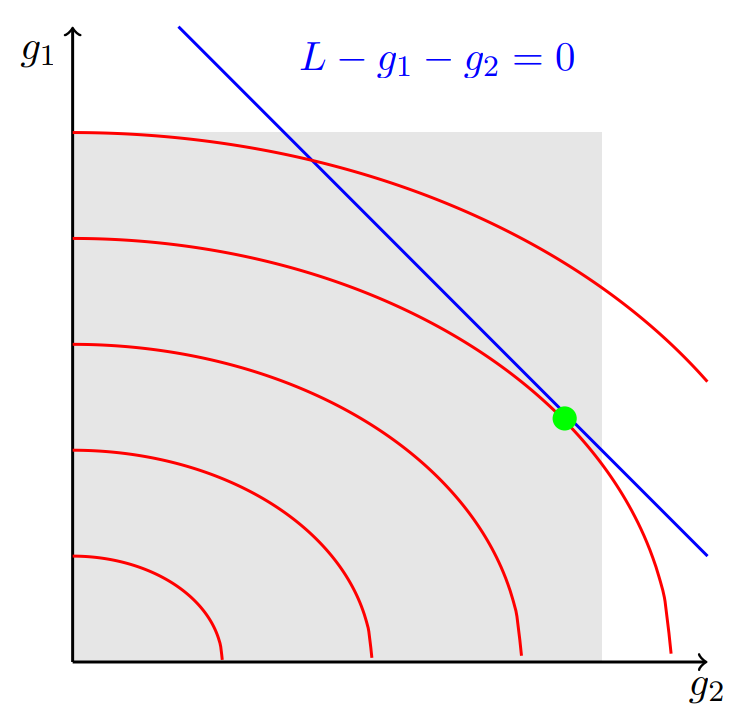

To solve the problem with equality and inequality constraints, we extend our graphical interpretation. The grey area in Fig. 4.6 is the feasible region because it represents the feasible range of output of

Fig. 4.6 Graphical representation of the equality and inequality constrained economic dispatch problem#

The optimal solution needs to be part of the feasible solution set. In this case, we see that the optimal solution (green dot) is indeed in the feasible area. Thus the inequality constraints

From linear to quadratic problems

Recall that in Section 2.1, we were able to say that an optimal solution (if it exists) would always lie at one of the corners of the feasible region. Here, however, we now have a solution in the interior of the feasible region. You can see why when you look at the contour lines: they are no longer linear. We are dealing with a quadratic problem here.

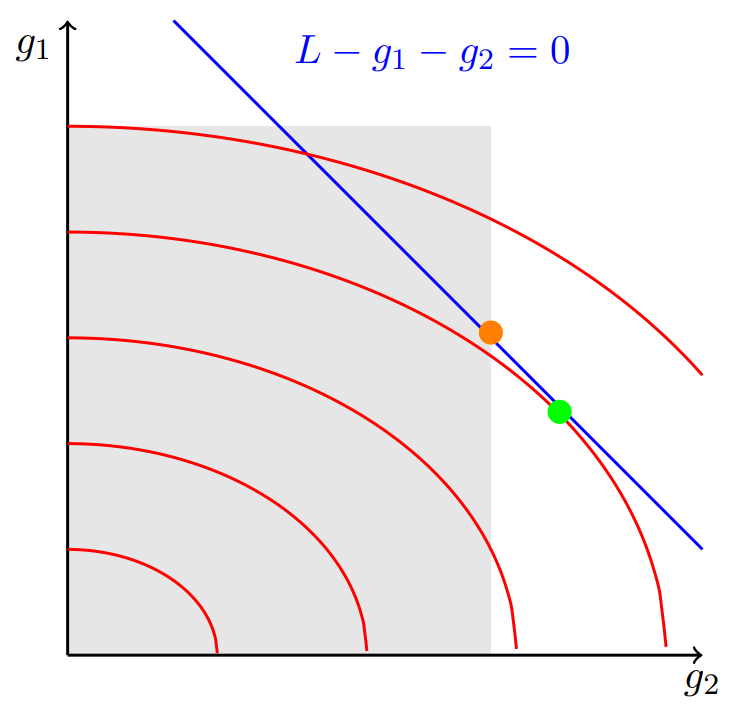

However, it will not always be the case that none of the inequality constraints play a role. What if the capacity limits on

For most problems, we do not know which constraints will be active/binding. Luckily, we can use a set of optimality conditions called Karush-Kuhn-Tucker (KKT) conditions to reflect the fact that in some cases inequality constraints are binding and in some cases they are not.

Consider the general inequality and equality constrained optimisation problem written in standard form:

There are

The Lagrangian is:

To formulate the Lagrangian, we followed the same logic as before: elevate the equality and inequality constraints to the Lagrangian. The Lagrangian has three components: the original objective function, the equality constraints multiplied by their Lagrange multipliers, and the inequality constraints multiplied by their Lagrange multipliers.

Then, with the help of the Lagrangian, we derive the following set of equations that characterises the optimal solution. These are the KKT conditions.

Note on inequality signs in standard form

Note that all constraints in a standard form have zeros on the right-hand side (i.e.,

Inequality constraints are always of the form

Let’s look at each of these equations in a little more detail. We have:

Derivative of Lagrangian w.r.t. decision variables

Derivative of Lagrangian w.r.t. Lagrange multipliers

Derivative of Lagrangian w.r.t. Lagrange multipliers

The multiplication of a Lagrange multiplier with its associated inequality constraint is zero

Lagrange multipliers

Let’s look more carefully at the interpretation of the complementary slackness conditions—the last two constraints in Equation (4.18):

If a constraint is binding, we can replace the inequality sign with an equality sign, so we have

Now we want to find a solution to the set of equations (values for

Condensed form of KKT conditions

Note that sometimes KKT conditions are written in condensed form:

Let’s revisit the economic dispatch example and apply KKT conditions. In the standard form we want to use here, the constraints are written separately with a zero on the right-hand sign and “=” or “

This makes it easy to write the Lagrangian, following Equation (4.17):

Then we derive the KKT conditions:

Clearly, this is a large set of equations. This problem is not trivial to solve because the complementary slackness constraints are non-linear. For simple cases addressed in this course, we can solve the problem by using trial-and-error: “What if a certain constraint

Let’s look at the problem graphically (see Fig. 4.7). We assume that the feasible range of values for

Fig. 4.7 Graphical representation of the economic dispatch problem with reduced feasible range for

Given this test solution, we know that

The only unknown variables are

Ok, you might ask: what is this all good for? KKT conditions can help us find the optimal solutions to nonlinear problems (we don’t need them for linear problems), and we will apply them when looking at mixed complementarity problems in Section 6. But they also give us a different view on duality, and this is what we want to turn our attention to last.

4.3. The connection between duality and KKT conditions#

We know that for every primal problem, there exists a dual problem, but how do we formulate the dual problem?

Recall the general formulation of a primal problem:

The Lagrangian is:

The Lagrangian dual function, or dual function, is the minimum of the Lagrangian:

with “inf” a generalisation of the “min” operator.

The dual function defines a lower bound on the optimal value

This is the dual problem. We denote the optimal value of this problem as

As mentioned at the beginning, strong duality is when the optimal value of the primal equals the optimal value of the dual. In our new terminology, this is written as

Weak duality is when

In practice, we do not need to start from the general expression in Equation (4.28) to derive the dual problem. Instead, we can simply follow the steps introduced above (Section 4.1.3): write the primal problem in standard form and then mechanistically translate it into its dual counterpart.

4.4. Further reading#

For more background on duality and to dive deeper into the mathematics, we suggest reading Chapter 5 of Boyd and Vandenberghe [2004] which is freely available online.

For alternative introductions to duality and KKT conditions based on a vector/matrix formulation, see Appendix B in Morales et al. [2014] (possibly available for free as an ebook if you are connected to a university network).

4.5. References#

Stephen Boyd and Lieven Vandenberghe. Convex Optimization. Cambridge University Press, Cambridge, UK ; New York, 1st edition edition, March 2004. ISBN 978-0-521-83378-3.

Frederick S. Hillier and Gerald J. Lieberman. Introduction to Operations Research. McGraw-Hill Education, New York, NY, 11th edition, 2021. ISBN 9781259872990.

Juan M. Morales, Antonio J. Conejo, Henrik Madsen, Pierre Pinson, and Marco Zugno. Integrating Renewables in Electricity Markets: Operational Problems. Volume 205 of International Series in Operations Research & Management Science. Springer US, Boston, MA, 2014. ISBN 978-1-4614-9410-2 978-1-4614-9411-9. doi:10.1007/978-1-4614-9411-9.